Break Analytics three-tiered IRA software solution enables you to set your clients on a smooth course through retirement and beyond. Our tools help you meet your fiduciary responsibility by leveraging thousands of variables and simulating billions of scenarios to assist your client in making informed financial decisions for Required Minimum Distribution (RMD), Inherited IRA, and Roth Conversion planning.

RISE Accuracy

Provides classic retirement planning solutions at its best. RISE includes:

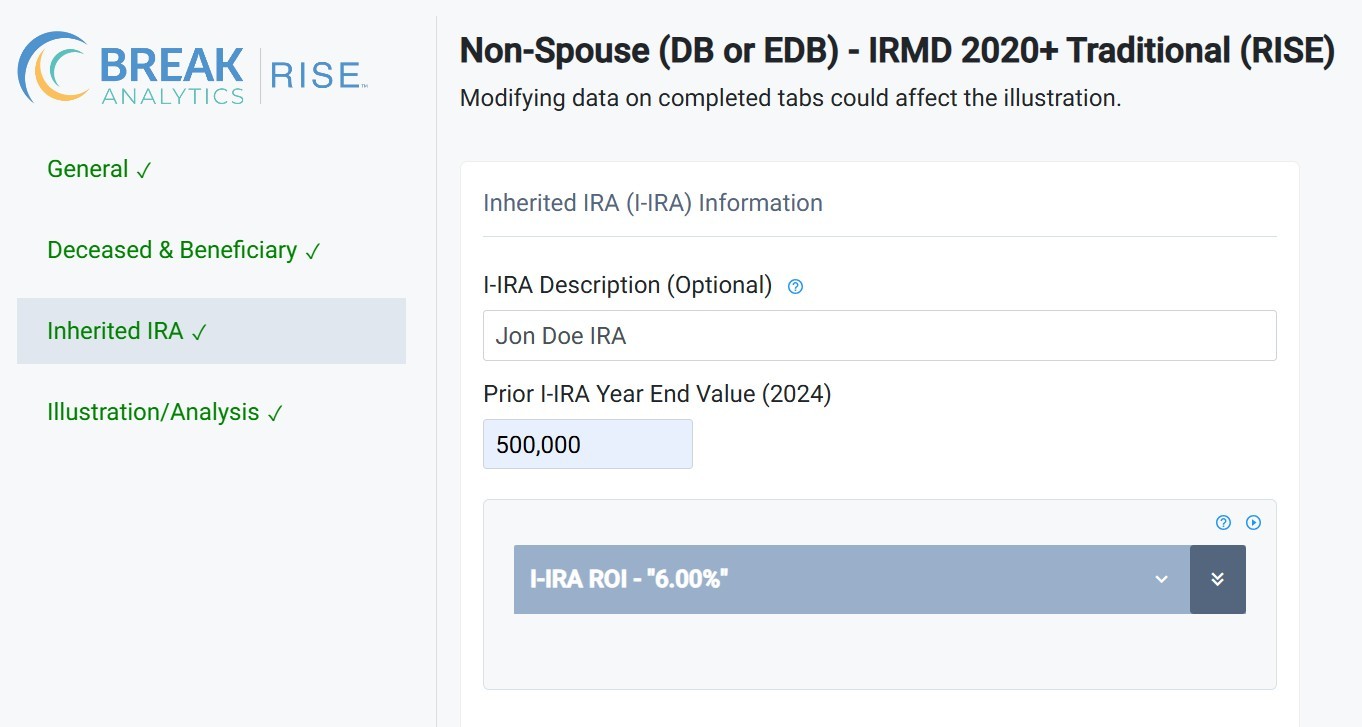

- Easy to navigate interface

- Smoothing™ for Inherited IRA distributions

- Gross distribution projections

- Year-by-year entry for account activity and assumptions

CREST Insight

Delivers advanced distribution planning with a holistic approach. CREST includes:

- Everything in RISE

- Precise Course™ Optimization

- Income tax calculation for net distributions & spending

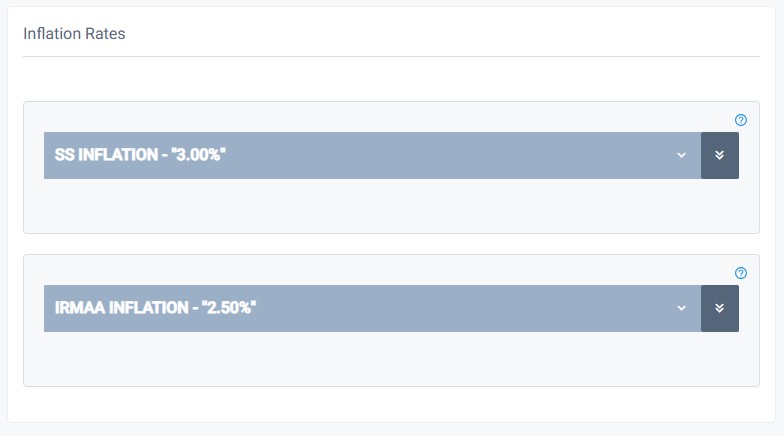

- Inflation Rates for IRS, Social Security, IRMAA, and Real Inflation Assumptions

EPIC Clarity

Offers our most sophisticated estate, generational, and philanthropic planning tools. EPIC includes:

- Everything in RISE & CREST

- Estate Tax Calculation

- Income in Respect to Decedent (IRD) recovery on Inherited IRAs

- Gifting and charitable philanthropic scenarios

- Client’s optimized wealth picture

RISE Accuracy – Covering the Fundamentals

- Quick Data Entry: Input your client’s information using our easy-to-use forms.

- Visually Pleasing Illustrations: Generate attractive and educational PDFs.

- Essential calculation modules: RMDs for IRA owners, Distributions for beneficiaries (pre 2020 and SECURE Act regulations), Roth conversions, and Substantially Equal Periodic Payments (SEPPs).

CREST Insight – Adaptability for Customization

- Incremental Adjustments: Fine-tune inputs for metrics such as federal tax rates, inflation, and return on investment (ROI).

- Impact Projections: Illustrate the effects of Traditional IRA distributions on your client’s Social Security taxes, income-related monthly adjusted amount (IRMAA) fees, numerous MAGIs and federal income tax.

- Smoothing ™ Inherited IRA Distributions: Enhance your ability to refine your client’s taxable Inherited IRA distributions with our Smoothing ™ feature.

- Roth Conversion Management: Our Precise Course ™ features allows you to model the optimized path through the tax system for Roth conversions, tailored to your client’s specific situation.