Advanced RMD Planning for Financial Advisors

Proactive Distribution Strategies, Tax Modeling & QCD Optimization

Required Minimum Distributions (RMDs) aren’t just a compliance checkpoint—they’re a powerful tool for strategic retirement planning. Break Analytics empowers financial advisors to proactively guide clients with RMD planning through retirement income decisions, maximize charitable giving opportunities and reduce tax exposure with precision.

Whether your client is approaching RMD age or already navigating distributions, our platform equips you to project RMDs, simulate Qualified Charitable Distributions (QCDs), and model tax outcomes overtime, bringing clarity to complex retirement scenarios.

What Are RMDs and QCDs?

The Internal Revenue Code (IRC) mandates that IRA owners begin annual distributions, once reaching RMD Age. These distributions, known as RMDs, ensure that tax-deferred retirement savings eventually become taxable. This is good news for advisors, as RMDs also present a strategic planning opportunity.

Understanding your client’s RMD start date is key to modeling distributions, avoiding tax spikes, and identifying optimal windows for Roth conversions. Recognizing the timing of Required Minimum Distributions helps in effective tax planning.

RMD Age

Importantly, RMDs don’t start at the same age for everyone. Here’s how it breaks down:

- Age 75 → If born in 1960 or later

- Age 73 → If born after 1950

- Age 72 → If born after June 30, 1949

- Age 70½ → If born before July 1, 1949

QCDs are a tax-smart way for clients age 70½ or older to donate directly from Traditional and Inherited Traditional IRAs to qualified charities. QCDs can satisfy all or part of an RMD or exceed it without increasing taxable income—making them a powerful tool for tax mitigation.

Break Analytics helps advisors turn these rules into opportunities—projecting distributions, modeling tax outcomes, and optimizing charitable strategies with precision.

Why Advisors Need Proactive RMD Planning

- Model pre-RMD age distributions to smooth income and avoid tax spikes

- Project RMDs and estimate applicable taxes to help clients plan ahead with clarity and confidence

- Simulate QCD strategies to reduce taxable income and align with charitable goals

- Visualize multi-year outcomes with IRS-aligned inflation and MAGI adjustments

“Taking distributions early can reduce IRMAA surcharges, avoid bracket creep, and create Roth conversion windows.” — Inspired by Kitces.com

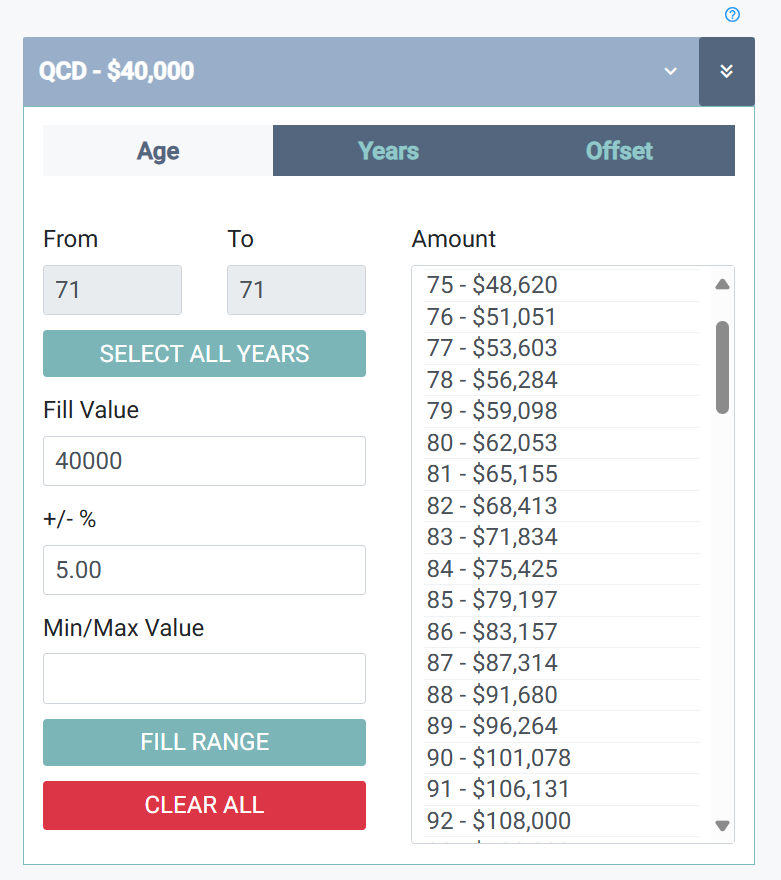

QCDs: Charitable Giving with Tax Efficiency

QCDs allow clients age 70½ or older to donate directly from Traditional and Inherited Traditional IRAs—reducing taxable income. QCDs may also partially or fully satisfy RMDs, or exceed them. Break Analytics helps advisors:

- Manage AGI to help control Medicare Premiums

- Project tax savings

- Maximize best strategies through strategic charitable giving

What You Can Model with Break Analytics

RMD projections with tax overlays

Distribution timing strategies before RMD age

QCD eligibility and charitable impact modeling

Social Security and IRMAA interaction analysis

Inherited IRA smoothing with compliance aligned education

Roth conversion pathways with tax tradeoff insights

Ready to Help Clients Plan Smarter?

Break Analytics is built for advisors who want to lead with strategy—not just react to compliance. Using smart tactics for Required Minimum Distributions can be a game changer.

Request a Demo and see how our platform helps you deliver clarity, confidence, and tax-smart retirement planning.

RMD & QCD Frequently Asked Questions

By April 1 of the year after the IRA owner turns RMD age.

If the first RMD is delayed until April 1 of the year after reaching RMD age, two RMDs are taken in that same calendar year:

– One for the prior year (the delayed first RMD), and

– One for the current year (due by December 31).

This double distribution can increase taxable income for that year, potentially pushing the client into a higher tax bracket or triggering other income-based thresholds (like IRMAA surcharges or phaseouts for deductions and credits).

Yes, for all SEP, SIMPLE and Traditional IRAs owned by the same individual. RMDs can be calculated separately and then taken from one or more of those IRAs.

However, RMDs from employer-sponsored plans—such as 401(k), 403(b), and governmental 457(b) accounts—must be taken separately from each plan. You cannot aggregate RMDs across different employer plans, or between IRAs and employer plans.

Additional rules to note:

Inherited IRAs must satisfy RMDs separately and cannot be aggregated with your own IRAs. Spouses cannot aggregate their RMDs with each other.

403(b) accounts can be aggregated with other 403(b)s, but not with IRAs or other employer plans.

No, if you are a 5% or more owner of the company. You must take RMDs annually.

Individuals age 70½ or older.

Yes, QCDs can be made from an Inherited Traditional IRA, as long as the beneficiary is age 70½ or older at the time of the distribution.

However, QCDs are not allowed from Inherited Roth IRAs, since qualified Roth distributions are already tax-free, and therefore do not offer the same tax advantage.

No, QCDs must come from IRAs.

No, they cannot.

Yes, a one time QCD up to $54,000, the current allowable amount, can be directly sent to certain split interest entities.

Yes, if the custodian allows it.