Inherited IRA Calculator Suite for Advisors

From Confusion to Clarity: Inherited IRA Guidance with Break Analytics’ Built-In Calculator

Smarter Strategies. Clearer Compliance. Confident Guidance. Navigating Inherited IRA rules can be overwhelming—especially with ever-changing IRS regulations. Break Analytics’ Inherited IRA calculator suite simplifies the process by automatically identifying the beneficiary type, calculating RMDs, when necessary, and enabling flexible custom distribution strategies, all while being compliant with IRS rules. Ready to take control? Request a personalized demo today.

What Is an Inherited IRA?

An Inherited IRA is a retirement account transferred to a beneficiary after the original IRA owner’s death. The IRS requires specific distribution rules based on several factors, including:

✦ Beneficiary type: Eligible Designated, Designated, or Non-Designated

✦ Beneficiary classification: Individual vs. entity

✦ Timing of the account owner’s death: Before, on, or after their Required Beginning Date (RBD)

✦ Relationship to the deceased: Spouse or non-spouse

To provide accurate guidance, advisors must understand the 10-Year Rule, the life expectancy method, and when Required Minimum Distributions (RMDs) apply.

Why Advisors Need an Inherited IRA Calculator

Since the SECURE Act and new IRS’ 2024 Final RMD Regulations, inherited IRA planning has become significantly more complex. Advisors now face nuanced scenarios, including:

- Differentiating Eligible Designated Beneficiaries (EDBs) from Designated Beneficiaries (DBs) and Non-Designated Beneficiaries (NDBs)

- Managing a minor child of the IRA owner beneficiary with hybrid EDB/DB status

- Adjusting strategies based on whether the IRA owner died before, on, or after their RBD

- When necessary, calculating annual RMDs under the 10-Year Rule, ensuring IRS compliance

Break Analytics’ Inherited IRA RMD calculator streamlines planning by automating beneficiary classification, calculating RMDs, and continuously updating the platform to reflect current laws and IRS regulations—reducing errors and enabling advisors to focus on delivering optimal client outcomes.

Key Features of Break Analytics’ Inherited IRA Calculator

Beneficiary Classification

Automatically identifies EDBs, DBs, and applies the correct IRS rules.

IRS vs. Client Plan Comparison

Visualize tax implications using interactive ledgers and graphs.

RBD-Aware Calculations

Adjusts distributions based on whether the IRA owner died before, on or after their RBD.

Advanced Distribution Management

Tracks EDB stretch terms and adjusts RMDs based on beneficiary type and RBD timing. Offers flexible strategies like Distribution Smoothing™ and Precise Course™.

Tax Forecasting & Optimization

Estimates tax liabilities and models after-tax outcomes.

Built-In Regulatory Updates

Integrates SECURE Act & 2.0, IRS Final RMD Regs, and key tax rules from the “One Big Beautiful Bill” to maintain compliance with current law.

Benefits for Financial Advisors

- Build trust through data-driven, personalized distribution strategies

- Stay informed with real-time updates to IRS rules and legislation

- Minimize compliance risk with accurate, up-to-date RMD schedules

- Deliver clear, visual guidance tailored to each client

- Save time by automatically applying IRS distribution rules, reducing manual calculations and simplifying complex scenarios

Get Started with Break Analytics

Break Analytics’ Inherited IRA Calculators help financial professionals navigate complex IRS rules, calculate RMDs, and build personalized distribution strategies with confidence.

- Case Study – See the $2M Inherited IRA Mistake

- Read Our Captain’s Blog – Stay informed with the IRA Oracle’s Commentary and industry updates

- Roth Conversion Tool – Compare tax outcomes & optimize timing

Inherited IRA Frequently Asked Questions

Our software is built specifically for financial advisors. It’s easy to navigate interface integrates complex IRS rules, multi-year RMD planning, and tax forecasting into one streamlined platform—making it more than just a basic calculator.

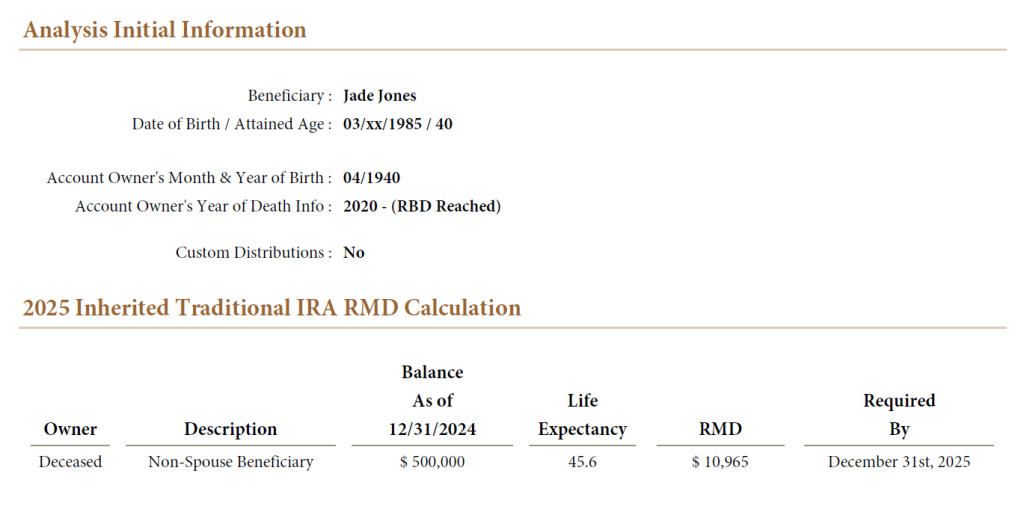

Under current IRS regulations, non-spouse Designated Beneficiaries must fully deplete an Inherited IRA within 10 years of the original IRA owner’s death. However, whether Required Minimum Distributions (RMDs) are needed each year depends on if the IRA owner died before, on or after their Required Beginning Date (RBD).

Break Analytics beneficiary IRA calculators simplify this process. With just the basic account details, our calculator determines whether annual RMDs apply and generates a distribution timeline tailored to the beneficiary’s situation, helping financial professionals provide accurate, timely guidance.

Yes. The calculator applies IRS distribution rules for minor children, who are considered Eligible Designated Beneficiaries (EDBs) under the 2024 Final RMD Regulations. It calculates life expectancy-based RMDs until the child reaches age 21. At that point, the 10-Year Rule begins, with continued annual RMDs—regardless of whether the IRA owner died before or, on, or after their RBD.

The answer depends on the spouse’s age and if they need access to the money. The surviving spouse has two primary options:

1) Establish an Inherited IRA – Distributions avoid the 10% additional tax for early or pre-59 ½ distributions.

No RMDs until the deceased spouse reaches their RMD Age, had they lived. This may be beneficial to surviving spouses already RMD Age.

RMDs are necessary if the deceased was already RMD Age.

RMD Age depends on their year of birth:

– Age 75 (if born in 1960 or later)

– Age 73 (if born 1951–1959)

– Age 72 (if born July 1, 1949 – December 31, 1950)

– Age 70½ (if born before July 1, 1949)

2) Treat as their own – transferring or rolling it into their IRA allows the spouse to follow the RMDs rules as the owner.

Ready to Help Clients Plan Smarter?

Break Analytics empowers advisors to move beyond checkboxes and into strategy. Request a demo and discover how to deliver smarter Inherited IRA planning with clarity, confidence, and control.