Roth Conversion Software for Financial Advisors

Roth Conversions Can Be Daunting—Make Smarter Decisions with the Right Calculator.

Roth conversion planning for financial advisors can be crucial, and utilizing advanced Roth conversion software can significantly aid in helping clients making informed decisions.

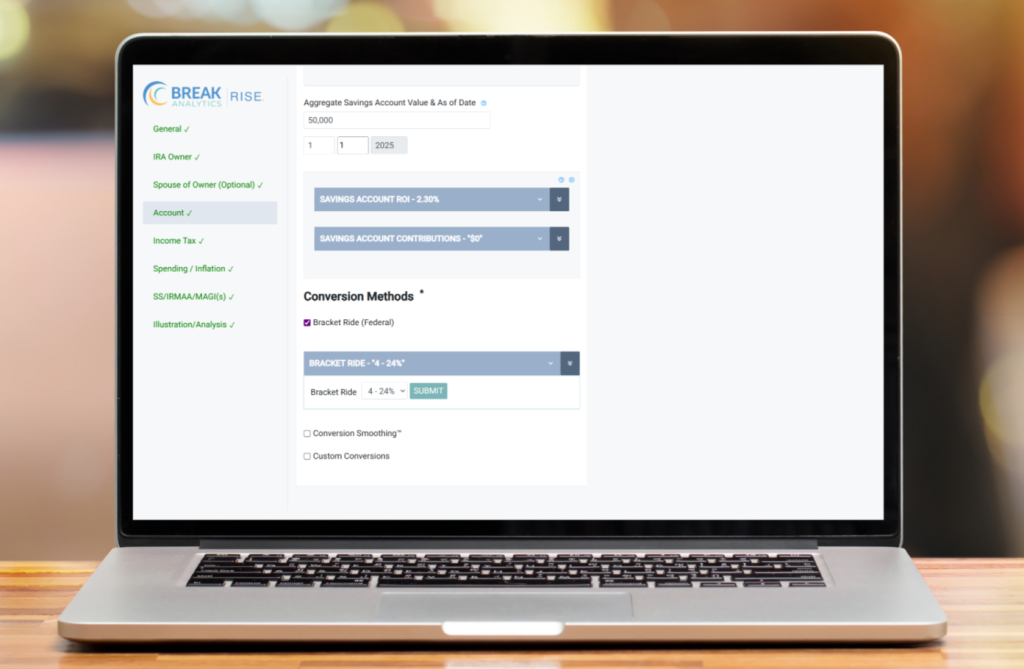

Choosing to convert a Traditional IRA into a Roth IRA is a major financial decision. While free calculators can offer basic estimates, they often lack the depth, flexibility, and precision that financial advisors need to serve their clients effectively. That’s why Break Analytics’ Roth IRA Conversion Calculator was built — to provide advisors with a powerful, customizable, and tax-aware solution for Roth Conversion Planning for Financial Advisors.

Why Advisors Choose Break Analytics

Financial advisors looking for a smarter way to model Roth conversions can turn to Break Analytics for its depth, accuracy, and strategic tools. Here’s why it’s a great Roth Conversion Planning tool for Financial Planners:

Smarter Assumptions for Accurate Planning

Adjust Roth conversion inputs annually—MAGI, tax brackets, market shifts, and client changes—for precision beyond basic calculators.

Tax-Aware Savings Integration

Estimate taxes and optimize payments using IRA balances, savings accounts, and efficiency metrics for tailored client guidance.

Conversion Strategies That Fit

Use Bracket Ride, Conversion Smoothing™, Custom Schedules, or Precise Course™ to match any client’s goals and timeline.

Inflation-Adjusted Tax Forecasting

Plan year-by-year with IRS inflation rates to keep strategies aligned with evolving tax laws and bracket shifts.

Consistently Compliant

Cloud-based and continuously updated to reflect the latest tax laws—no outdated assumptions.

Real-World Spending & Inflation

Forecast using actual spending goals and inflation data—no hypotheticals, just relevant, client-specific projections.

Start Planning Smarter Today

Standard Roth conversion calculators only scratch the surface. Break Analytics’ Roth IRA Conversion Calculator provides the data-driven insights financial advisors need to:

- Model tax-smart Roth conversions

- Forecast realistic retirement scenarios

- Minimize tax liabilities and optimize after-tax income

Roth Conversion Frequently Asked Questions

Yes, IRMAA is based on your MAGI from two years prior the current tax year. Think of it this way, your 2025 MAGI will determine your IRMAA for 2027. This two-year lookback makes proactive tax planning essential— increasing your income by initiating a Roth Conversion this year can impact your Medicare premiums 2 years from now.

Break Analytics’ Roth conversion tool is designed specifically for advisors. It offers deep customization, tax-aware strategies, and advanced forecasting features not found in basic calculators.

Free calculators offer basic estimates. Break Analytics allows for multi-year planning, tax bracket control, IRS inflation adjustments, and advanced algorithm-driven scenario analysis tailored to each client.

Absolutely. Advisors can model client spending goals, real inflation rates, and simulate net outcomes for better retirement planning insights.

Want to be the advisor who plans smarter Roth strategies? Book your free demo today and see how Break Analytics can elevate your Roth Conversion planning.